Arizona W9 Form 2025. This a partial list of the most commonly used unemployment insurance tax forms. For tax year 2025 and beyond, the tax rate for arizona taxable income is 2.5%.

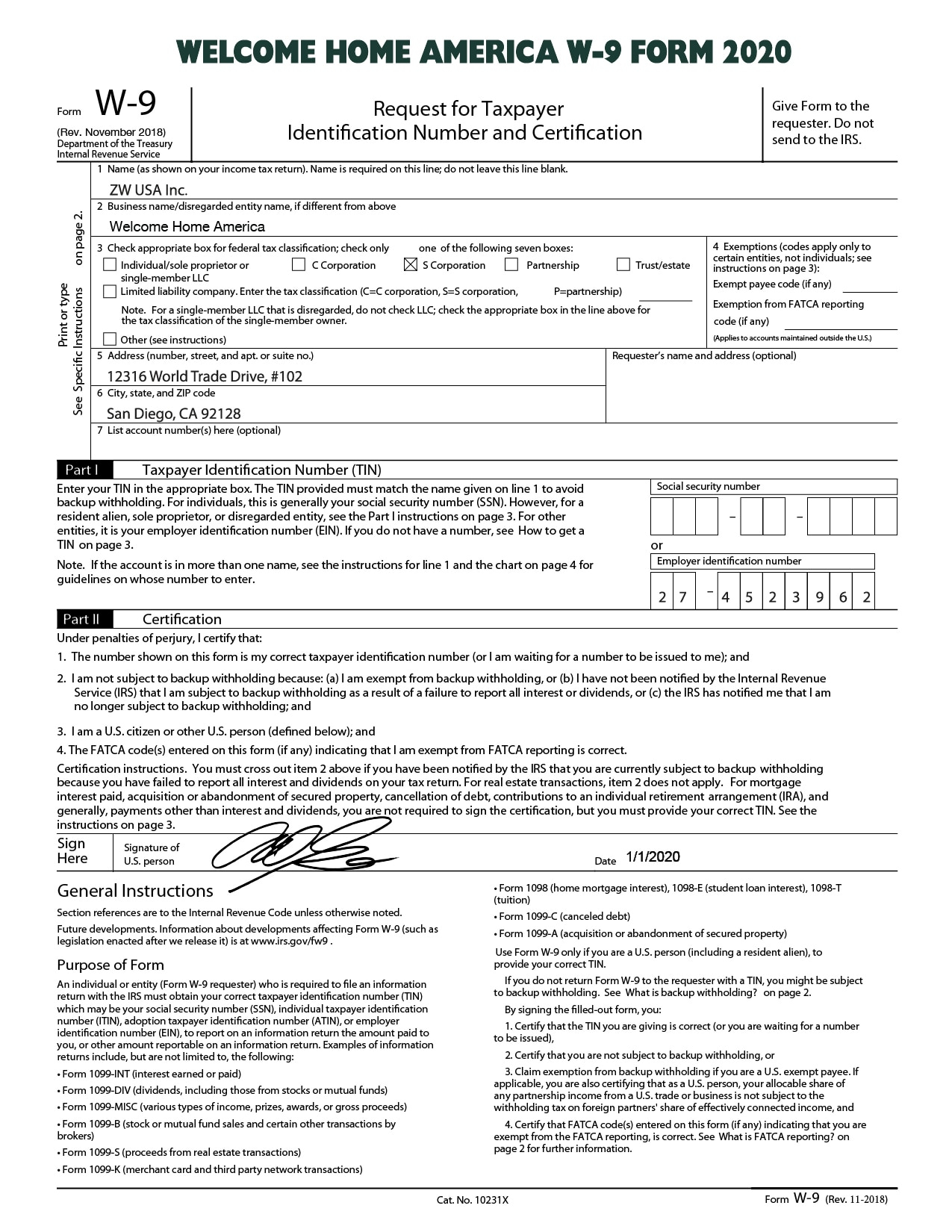

Last updated on jan 19, 2025. Use the arizona w9 form to establish or update a vendor account with the state of arizona.

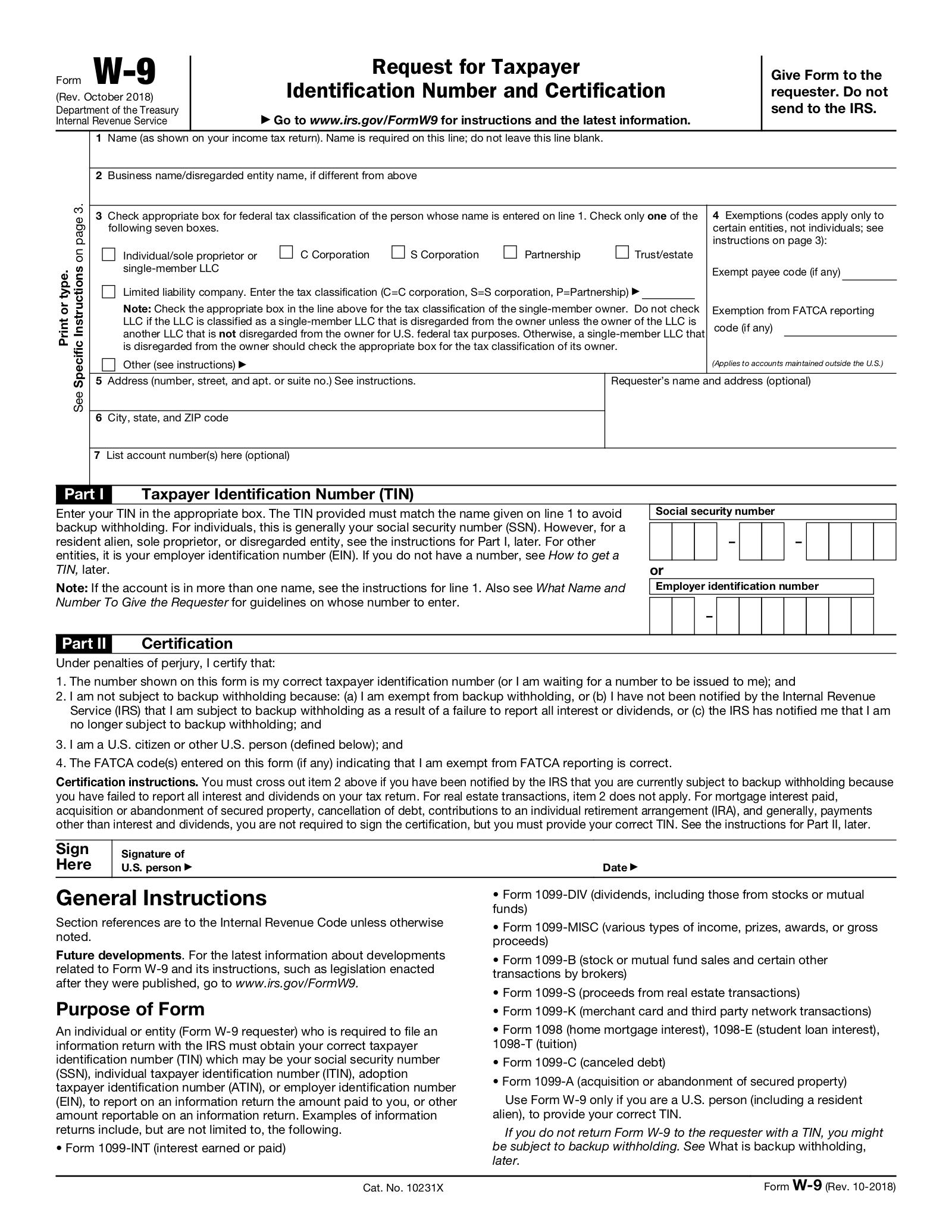

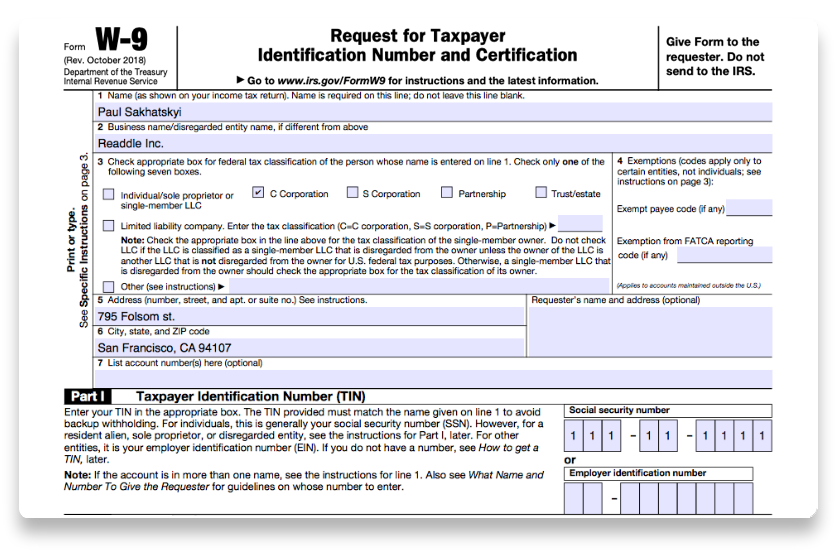

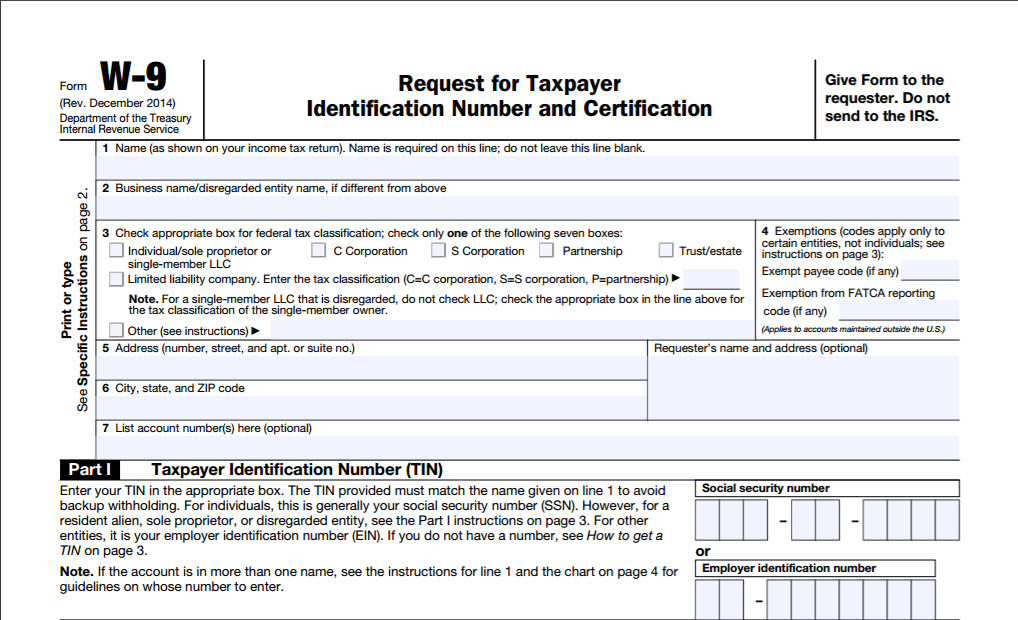

Free IRS Form W9 (2025) PDF eForms, This form is required in order to establish or update a vendor account with. The irs has released a final revised version of form w.

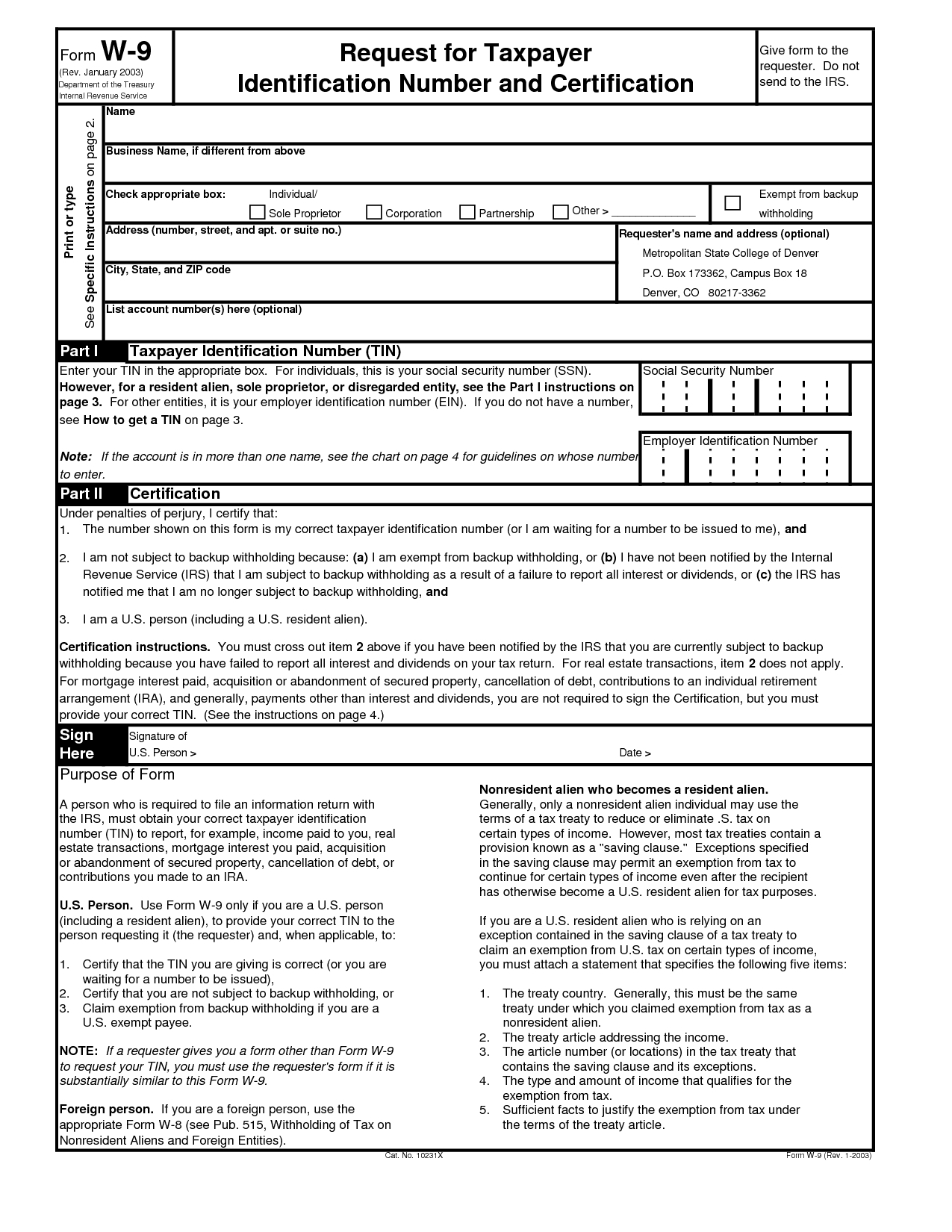

Printable Blank W9 Form Calendar Template Printable, A vendor that provides goods or services to an arizona state agency and. This form is required in order to establish or update a vendor account with the state of arizona.

Print A W9 2025 Example Calendar Printable, No printing or scanning requi. This form is required in order to establish or update a vendor account with.

Federal W 4 Worksheet 2025 Printable & Fillable Online Blank, Employers and payers have the. Statement of exemption & 2025 irs levy exemption chart.

Blank W4 Form and a Pen. Tax Season Stock Image Image of refund, The irs has released a final revised version of form w. Statement of exemption & 2025 irs levy exemption chart.

The W9 Requirement, Statement of exemption & 2025 irs levy exemption chart. A vendor that provides goods or services to an arizona state agency and.

"Me, Myself, and I Writing the Self in Memoir and Personal Essay, This form is required in order to establish or update a vendor account with the state of arizona. Annuitant's request for voluntary arizona income.

Cómo rellenar formulario W9 del IRS 20222023 PDF PDF Expert, This form is required in order to establish or update a vendor account with. Annuitant's request for voluntary arizona income.

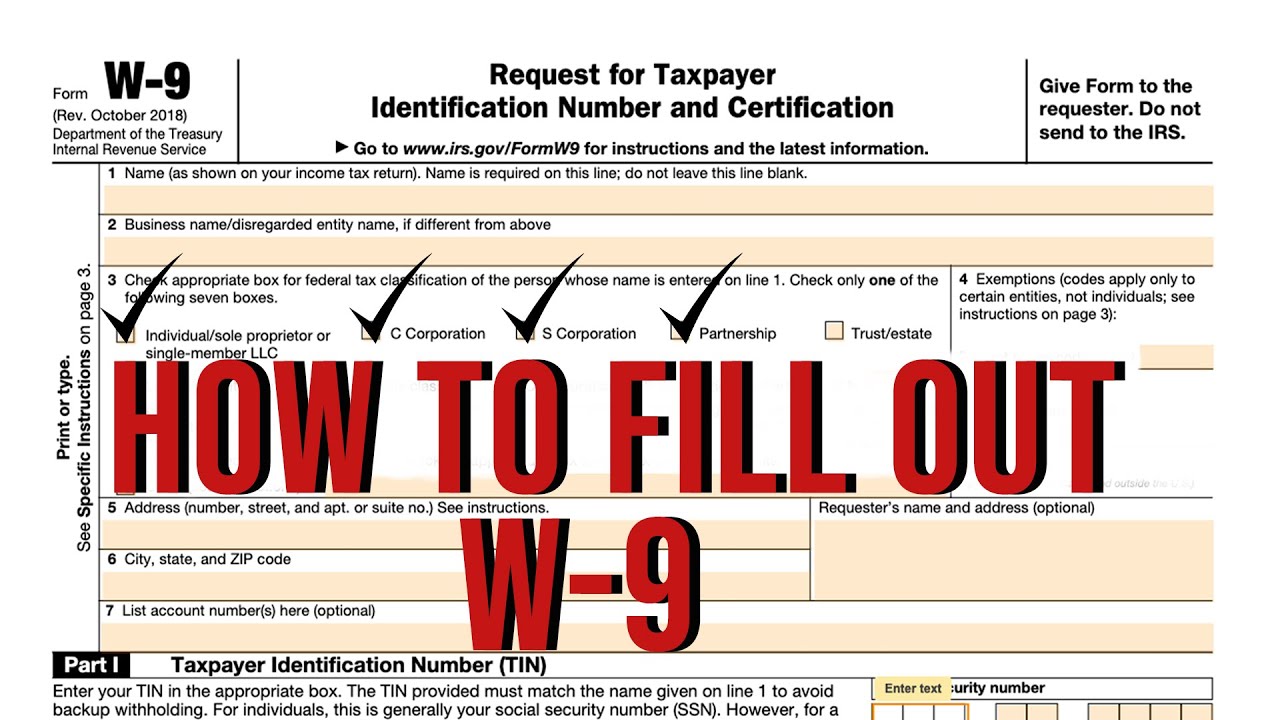

How to complete IRS W9 Form W 9 Form with examples YouTube, This a partial list of the most commonly used unemployment insurance tax forms. Select forms from the dropdown,.

Free Fillable W9 Form 2025 Cammy Caressa, 20 rows withholding forms. For tax year 2025 and beyond, the tax rate for arizona taxable income is 2.5%.

The original line 3—federal tax classification has now been split into two sections, line 3a and line 3b.