Tax Break For Dependents 2025. Credits, deductions and income reported on other forms or schedules. The credit begins to phase out when the filer's modified adjusted gross.

A dependent is a qualifying child or relative who relies on you for financial support. This credit was temporarily expanded up to $3,600 in 2025, but it has.

For the 2025 tax year (tax returns filed in 2025), the child tax credit will be worth $2,000 per qualifying child, with $1,700 being potentially refundable through the.

What is the average tax return for a single person making 50000? Leia, The child tax credit helps families with. Credits, deductions and income reported on other forms or schedules.

IRS Names Microcaptives as Top Abusive Tax Scheme, For tax years prior to 2018, every qualified dependent you claimed could reduce your taxable income. To claim a dependent for tax credits or deductions, the dependent must meet.

Tax Deduction For Dependents 2025 Clem Melita, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. The dependent tax credit in 2025 and 2025 is a brand new tax credit.

Some Remote Workers Lose an Important Tax Break FlexJobs, Here are the rules — and how much a tax dependent could save you. The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

How to fill out IRS Form W4 Married Filing Jointly 2025 YouTube, And unless congress makes legislative changes to the credit, the child tax credit will remain at up to $2,000 for 2025. The credit begins to phase out when the filer's modified adjusted gross.

UK Animation Tax Break Increases to 39 THE ART OF VISUAL EFFECTS AT, For the 2025 tax year (tax returns filed in 2025), the child tax credit will be worth $2,000 per qualifying child, with $1,700 being potentially refundable through the. Learn who qualifies and how to claim this credit.

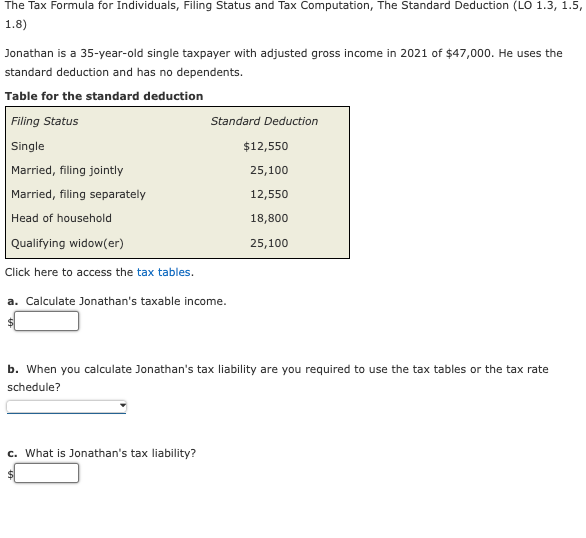

Solved The Tax Formula for Individuals, Filing Status and, The child tax credit helps families with. Federal estate & gift tax.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, For the 2025 tax year (tax returns filed in 2025), the child tax credit will be worth $2,000 per qualifying child, with $1,700 being potentially refundable through the. To claim a dependent for tax credits or deductions, the dependent must meet.

10 Things to Know About 1 Million Tax Break On Center Software, To claim a dependent for tax credits or deductions, the dependent must meet. Credits, deductions and income reported on other forms or schedules.

W4 for Married filing jointly with dependents. w4 Married filing, Check your 2025 irs federal income tax bracket to see if you fall into a lower bracket due to inflation, which could lower your tax bill next year. Federal estate & gift tax.

If the tax relief for american families and workers act of 2025, currently awaiting a senate vote, becomes law, the refundable version of the child tax credit would.